Considerations When Making Gifts to Children

If you make significant gifts to your children or someone else's children (perhaps a grandchild, a nephew, or a niece), or if someone else makes gifts to your children, there are a number of things to consider.

Nontaxable Gift Transfers

There are a variety of ways to make transfers to children that are not treated as taxable gifts. Filing a gift tax return is generally required only if you make gifts (other than qualified transfers) totaling more than $15,000 per individual during the year.

- Providing support. When you provide support to a child, it should not be treated as a taxable gift if you have an obligation to provide support under state law. Parents of minor children, college-age children, boomerang children, and special-needs children may find this provision very useful.

- Annual exclusion gifts. You can generally make tax-free gifts of up to $15,000 per child each year. If you combine gifts with your spouse, the amount is effectively increased to $30,000.

- Qualified transfers for medical expenses. You can make unlimited tax-free gifts for medical care, provided the gift is made directly to the medical care provider.

- Qualified transfers for educational expenses. You can make unlimited gifts for tuition free of gift tax, provided the gift is made directly to the educational provider.

For purposes of the generation-skipping transfer (GST) tax, the same exceptions for nontaxable gift transfers generally apply. The GST tax is a separate tax that generally applies when you transfer property to someone who is two or more generations younger than you, such as a grandchild.

Income Tax Issues

A gift is not taxable income to the person receiving the gift. However, when you make a gift to a child, there may be several income tax issues regarding income produced by the property or from sale of the property.

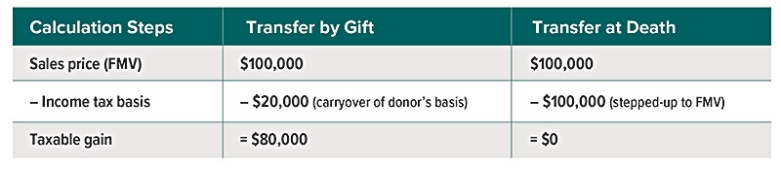

Transfer by Gift Versus Transfer at Death

Difference in taxable gain when appreciated property is sold at fair market value (FMV) after the transfer.

- Income for support. Income from property owned by your children will be taxed to you if used to fulfill your obligation to provide support.

- Kiddie tax. Children subject to the kiddie tax are generally taxed at their parents' tax rates on any unearned income over $2,200 (in 2021). The kiddie tax rules apply to: (1) those under age 18, (2) those age 18 whose earned income doesn't exceed one-half of their support, and (3) those ages 19 to 23 who are full-time students and whose earned income doesn't exceed one-half of their support.

- Basis. When a donor makes a gift, the person receiving the gift generally takes an income tax basis equal to the donor's basis in the gift. The income tax basis is generally used to determine the amount of taxable gain if the child then sells the property. If instead the property were transferred to the child at your death, the child would receive a basis stepped up (or down) to the fair market value of the property.

Gifts to Minors

Outright gifts should generally be avoided for any significant gifts to minors. For this purpose, you might consider a custodial gift or a trust for a minor.

- Custodial gifts. Gifts can be made to a custodial account for the minor under your state's version of the Uniform Gifts/Transfers to Minors Acts. The custodian (an adult or a trust company) holds the property for the benefit of the minor until an age (often 21) specified by state statute.

- Trust for minor. A Section 2503(c) trust is specifically designed to obtain the annual gift tax exclusion for gifts to a minor. Principal and income can (but need not) be distributed to the minor before age 21. The minor does generally gain access to undistributed income and principal at age 21. (The use of trusts involves a complex web of tax rules and regulations, and usually involves upfront costs and ongoing administrative fees. You should consider the counsel of an experienced estate professional before implementing a trust strategy.)